LLCs, or restricted responsibility organizations, have be more and popular, specially in Nevada. The primary reason behind recognition of LLCs is their power to combine the individual liability security of corporations with appealing duty advantages and the ease of forging a partnership. In addition, they are exceptionally variable and need less paperwork. LLCs might be setup as new entities, or turned from a preexisting business. Estimates reveal that Nevada, with 40,000 LLCs, has more than the corporate-friendly state of Delaware.

What are the huge advantages of a Nevada confined liability business? First, it gives safety from unique liability. second, it portrays an improved image of the business and increases its credibility. Next, it gives “pass-through” taxation. Last, also, it gifts increased privacy to the owners. The Nevada LLC today has become popular mainly due to Nevada’s pro-business environment and not enough a corporate money tax. No LLC clients may be sued for the LLCs obligation in Nevada.

The other benefits of a Nevada LLC are having less state tax, the convenience in producing and controlling LLCs, the typical eligibility, power for the synthesis of a single-member LLC, the flexibleness set up, the solitude advantages, gain defense power and corporate control, and the center for same-day formation of the LLC.

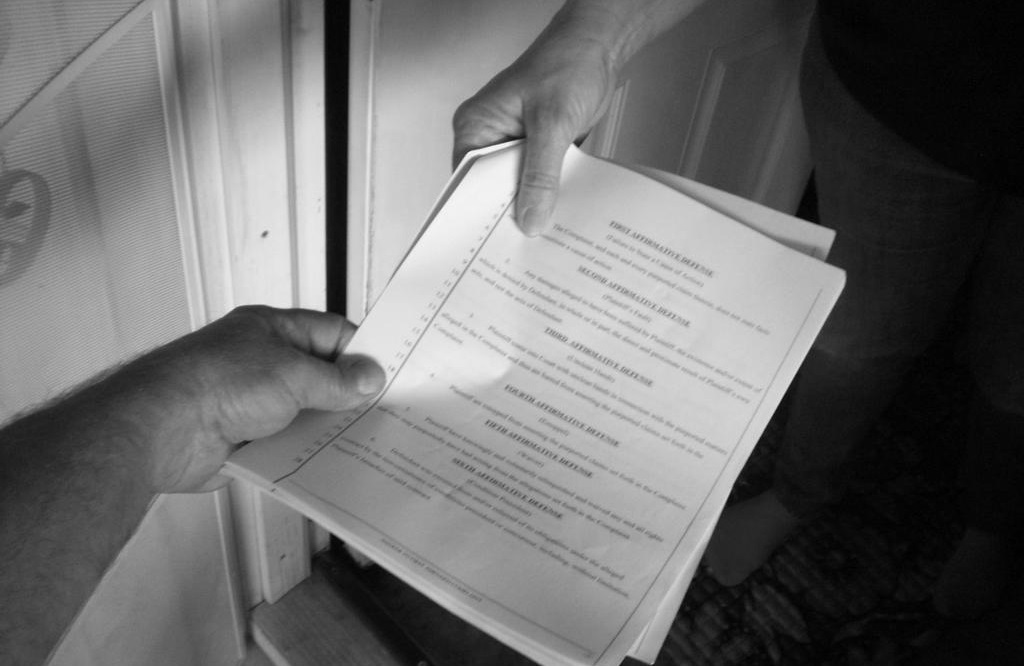

You’ll find specific corporations offering Nevada LLC services to organizations. These services contain name accessibility search, planning of the Nevada LLC software, performance of Nevada LLC running types, position checking of the application form, all conversation with the state of Nevada, a 24-hour online client status center, guarantee of processing achievement and the forwarding of important Houston Process Servers LLC, amongst others.

over issues are self-explanatory but the others requires explanation. When house other than money is added to an LLC by a member within original money contributions, the LLC’s schedule in the added assets is the same as each contributing member’s foundation in the resources before the share under Central Revenue Code Section 723. This means that the worthiness given to added resources on the books of the LLC (and also stated as preliminary added money in the LLC running agreement) is the cornerstone of said asset in the hands of the adding member. Typically, foundation is the cost taken care of the asset less any prior depreciation. Please seek advice from a duty skilled for more information on the topic. Possession passions are generally expressed in LLC running agreements as both products (akin to generally share in a corporation) or percentages of the whole. In the event that you proportion passions are assigned to the customers, make sure that the people percentage pursuits overall to 100%.

One usually sees little firms organized as LLC’s where in actuality the members receive their membership fascination with the LLC in exchange for stated potential companies as opposed to the contribution of money (or a mix of cash and assured future services). In such cases, it is essential for the LLC running contract to create forth in the maximum amount of depth as you are able to the services each member promises to offer the LLC. Also, what’re the penalties for disappointment to provide these services? Once the LLC struggles people maybe not rarely stroll down to follow different organization opportunities making the residual members to continue the business. Planning done in advance to deal with this dilemma shall save the LLC members significant frustration down the road should the LLC be confronted with this situation. Supermajority indicates lots above a bulk and generally identifies 2/3rds (or 66.7%). Dilemmas customers may wish to place a supermajority requirement upon for passing contain entry of new people, your choice to market significantly most of the resources of the LLC, and removal of the manager (if any).

LLC customers maybe not versed in the duty particulars of LLC’s tend to be surprised to find out that are taxed on all profits assigned for them by the LLC no matter whether or not the LLC actually makes money distributions to them. The hapless LLC member could find herself incurring a tax statement for that your LLC makes no distribution to cover. This is specially troublesome on group members who absence the capability to demand disbursement of LLC money to cover the tax liability streaming through for them personally from the LLC. This dilemma could be addressed by requesting in the functioning deal that, at least, a particular percentage of annual gains (such as 40%) be spread to the people each year where in fact the LLC includes a profit. As the total amount of gain given to each member is as yet not known before the LLC duty return is selected, it is frequent for the deadline for the necessary duty circulation to members to become a specific amount of days following the LLC tax return is selected (i.e., 30 days).

Withdrawal of LLC customers is a sticky subject. In certain states, such as for example Texas (see Texas Organization Agencies Rule Sec. 101.107), members don’t have any directly to withdraw from an LLC unless that correct is awarded in the LLC functioning agreement. In several respects, the coming together of customers to run your small business is similar to a marriage. Shouldn’t we assume there to be divorces? All parties are greater off if the customers set some level of planning for member withdrawal into their LLC functioning agreement. Yet another concern frequently neglected in running deal drafting is fiduciary duties owed by customers to at least one another. Especially crucial in this topic is perhaps the members will be allowed to perform company activities outside of the LLC and, more especially, whether the people may be permitted to be involved in the same business industry because the LLC that’ll probably compete with the LLC. It’s maybe not exceptional for state LLC acts to be silent or obscure on the issue. As an example, Delaware’s Restricted Liability Organization Behave makes no reference to enforcing fiduciary jobs upon members or managers of LLCs causing the problem to the contractual layout between the parties.